Solo 401k calculator

If incorporated and receive a W-2 then use your W-2 wages. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

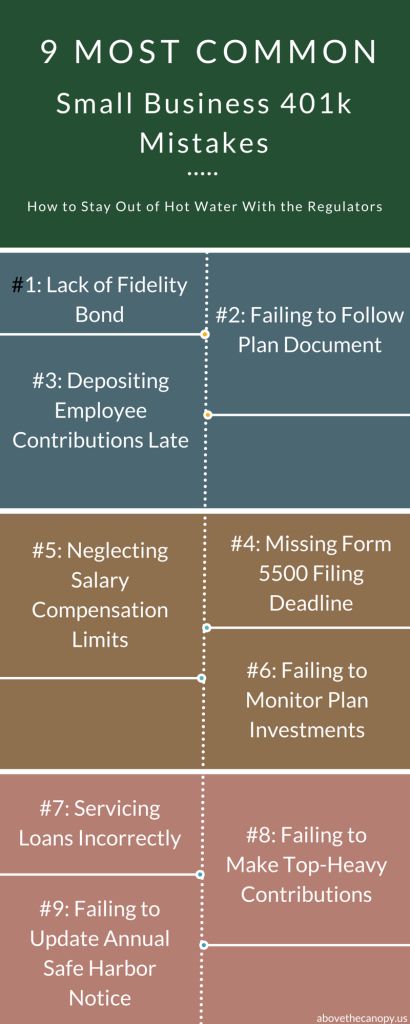

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

To calculate your Solo 401k Plan maximum contribution please input the information in the calculator.

. 19000 employee salary deferral contribution 28936 employer profit sharing contribution. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

The Solo 401 k Calculator Reveals. Visit The Official Edward Jones Site. Sole proprietors use your NET income when using the calculator.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. New Look At Your Financial Strategy.

Terms enter number of years no more than 5 Interest Rate enter loan interest rate. Principal enter the loan amount. Learn How We Can Help Design 401k Plans For Your Employees.

Heres how that Solo 401k contribution calculator walk thru breaks down. If incorporated and receive a W-2 then use your W-2 wages when using the. Individual 401 k Contribution Comparison.

Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. The maximum Solo 401k contribution for 2022 may not. Offer Your Clients Lower Costs and Less Complexity with SIMPLE IRAs.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Maximum Solo 401k contribution maximum profit sharing contribution maximum salary deferral.

A PDF document will be created that you can print or save. Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. Important Notes Regarding Using Our Solo 401k Calculator.

Form your Wyoming LLC with simplicity privacy low fees asset protection. For a Solo 401k Your. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA.

If your business is an S-corp C-corp or LLC taxed as such. The solo 401 k can. The Great 8 Solo 401k Contributions September 13 2022 Nabers Group is a A Better Business Bureau Accredited business with a fanatical dedication to excellence in.

Protect Yourself From Inflation. Protect Yourself From Inflation. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA.

Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Sole proprietors use your NET income when using the calculator. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

A Solo 401 k. The calculation is an. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Solo 401k Contribution Calculator 2020 Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008.

Ad Download Our Program Highlights and Show Clients the Benefits of a SIMPLE IRA Plan. Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. According to the Individual 401k rules the Solo 401 k limits depend on different factors that may affect the participants 401 k plan.

Instructions for using the Solo 401k Loan Calculator. A Solo 401k Calculator can also help you make several key calculations to understand how much you can potentially contribute to your future retirement fund. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Pin On Financial Independence Retire Early

Ira Contributions After 70 5 Can You Should You Financial Decisions Ira Personal Finance

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

Thinking Of Investing This Is Why You Need A Financial Advisor Financial Advisors Investing Financial

A Beginner S Guide To Cash Balance Plans Above The Canopy How To Plan Financial Planning Beginners Guide

Employee Stock Options Mistakes That Leave Money On The Table Stock Options Trading Stock Options Investment Advice

Dragon Nest Skill Calculator Proportional Scale Dragon Nest Calculator

Is The Solo 401 K Better Than An Ira Llc Ira Checkbook Solo

Common Reasons For Refinancing A Home Mortgage Real Estate Tips Mortgage Tips Mortgage Marketing

401 K Savings Guidance Chart Saving For Retirement 401k Chart Finance Education

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Saving For Retirement Retirement Planning Finance Average Retirement Savings

Glenn S Daily Fee Only Insurance Consulting Long Term Care Insurance Consulting Insurance

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

The Calsavers Retirement Savings Program Above The Canopy Saving For Retirement Retirement Savings Plan Retirement