34+ Simple 10 year mortgage calculator

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Thats savings worth 15716 per month.

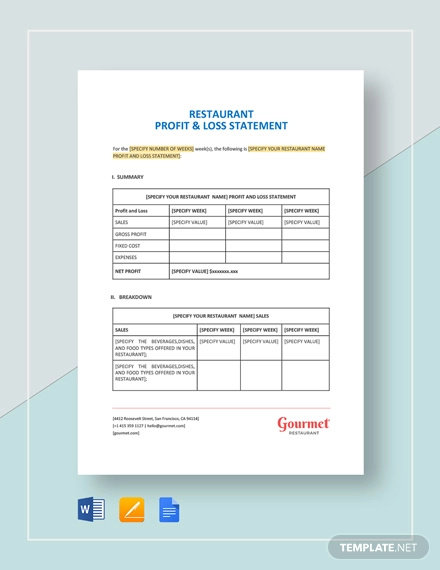

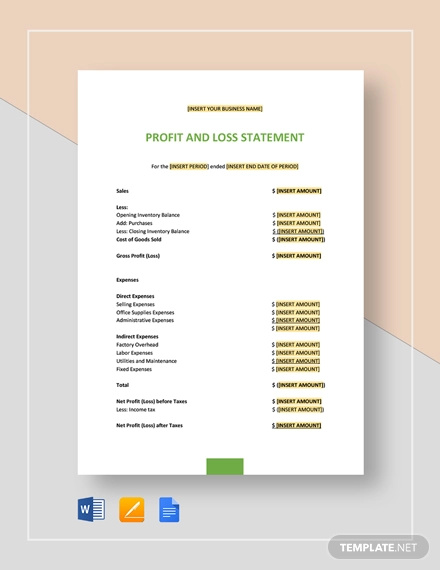

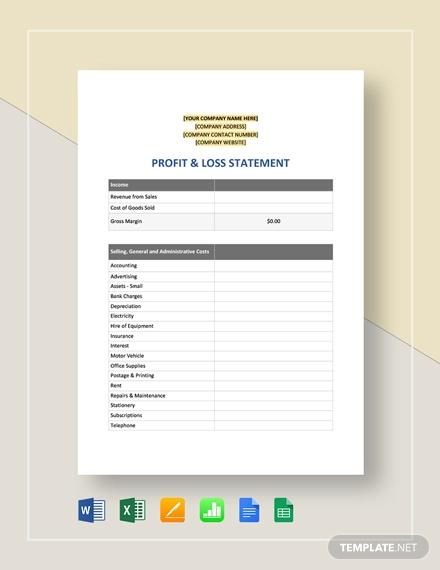

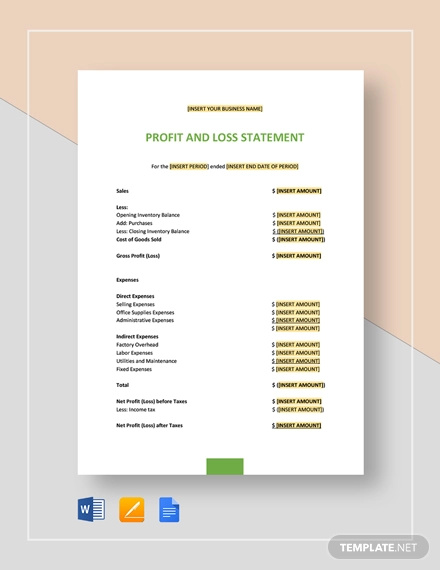

Profit And Loss Statement 34 Examples Format Pdf Examples

It is 10 years earlier.

. Ad Top Home Loans. Meanwhile with 20 down your monthly payment is further reduced to 125733. If Pay Extra 50000 per month.

Our calculator includes amoritization tables bi-weekly savings. Our simple mortgage calculator will show you your estimated monthly mortgage payment based upon the value of the home you want to buy your down payment amount and the interest rate and terms of. 37742 60 months 2264520 total amount paid with interest.

As of late-July 2022 the average national interest rate for a 30-year fixed-rate mortgage was in the mid 5 range. This calculation is accurate but not exact to the penny since in reality some actual payments may vary by a few cents. Dont Wait Take Advantage of Todays Historically Low Rates While You Still Can.

Minimum down payment amounts range from 5 to 20 depending on the home price. If you think you may sell or refinance the home in the first 5-10 years of the mortgage you could consider an adjustable-rate mortgage ARM. This will reduce the mortgage amount you need.

This calculator defaults to a 10-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. This results in savings of in interest.

10 Year Refinance Mortgage Calculator Sep 2022. 34 Simple 30 year mortgage calculator Minggu 04 September 2022 Edit. 391 rows In the example above a 10 down reduces your principal to 315000 while a 20 down further decreases your principal to 280000.

The average national interest rate for a 10-year fixed mortgage was 525. 10 Year Refinance Mortgage Calculator - If you are looking for a way to lower your expenses then we recommend our first-class service. Check out the webs best free mortgage calculator to save money on your home loan today.

Total interest paid is calculated by subtracting the loan amount from the total amount paid. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. 2264520 - 2000000 264520 total interest paid.

These rates were current as of publication though market conditions regularly change. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months. Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule.

Finally in the Interest rate box enter the rate you expect to pay. Closing costs for any kind of mortgage can total as much as 3 to 6 of the homes purchase price. Enter the amount between ten thousand and one million you plan to pay up front toward your home purchase.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. The following table shows monthly principal interest payments for 10 15 20 30-year FRMs along with 51 ARMs on a home loan of 220000.

Ad Compare Mortgage Options Calculate Payments. Its also a great option if you want to refinance to a shorter term. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

There are also closing costs associated with getting a mortgage typically from. Apply Now With Quicken Loans. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

An ARM offers a low fixed interest rate for a set introductory periodtypically 5 7 or 10 years. If you pay 10 down your monthly payment will cost 141449. This calculator allows you to calculate monthly payment average monthly interest total interest and total payment of your mortgage.

Get Your Estimate Today. Ad You Could be Saving Hundreds by Refinancing Your Mortgage. Or Refinance to Take Cash Out.

Avoid having to pay mortgage default insurance and make a down payment of 20 or more of the propertys value. Obtaining a 10-year mortgage is beneficial for people who can afford high monthly payments. Once the set introductory period ends the interest rate adjusts sometimes it goes up sometimes down.

Get The Service You Deserve With The Mortgage Lender You Trust.

03 Kitchen Island With A Built In Seating Area Digsdigs Decoracion De Cocina Moderna Decoracion De Cocina Diseno Muebles De Cocina

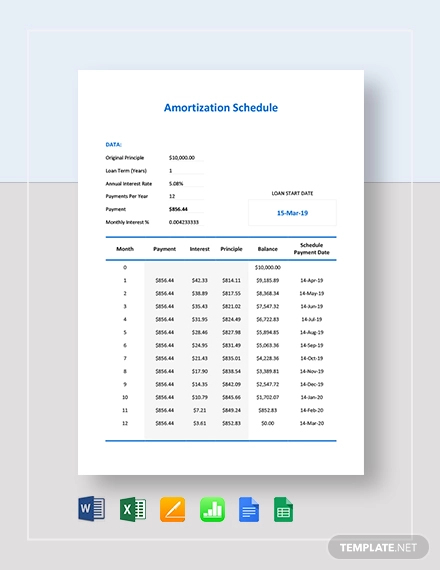

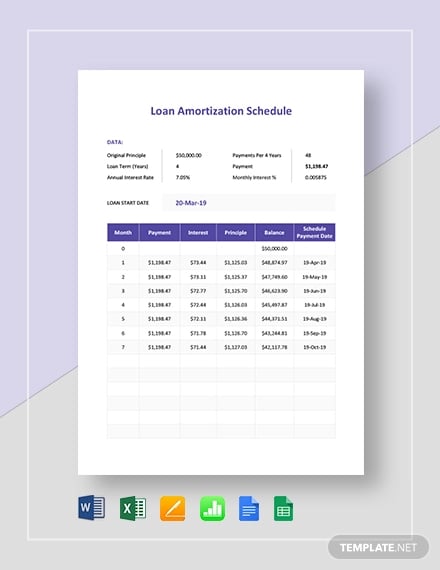

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

Simple Employee Recognition Awards Certificate Sample Within Employee Recognition Certi Employee Recognition Employee Awards Certificates Certificate Templates

Bucking Bull Etsy Wood Toys Plans Bucking Bulls Wood Toys

Profit And Loss Statement 34 Examples Format Pdf Examples

Pin By Lightfoot Youngblood Investm On Homes For Sale In Branson Missouri And The Surrounding Tri Lakes Area Outdoor Outdoor Structures Outdoor Decor

Profit And Loss Statement 34 Examples Format Pdf Examples

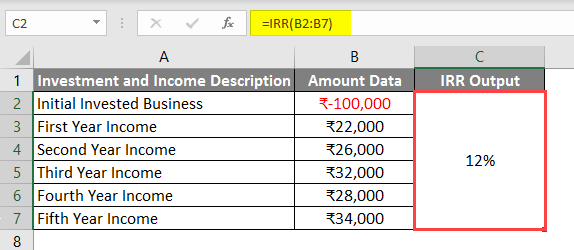

Excel Irr Formula How To Use Excel Irr Formula

9 Loan Amortization Schedule Template 7 Free Excel Pdf Documents Download Free Premium Templates

Image Result For Custom Bed Headboards Wood Bed Headboard Wood Custom Bed Simple Bed Frame

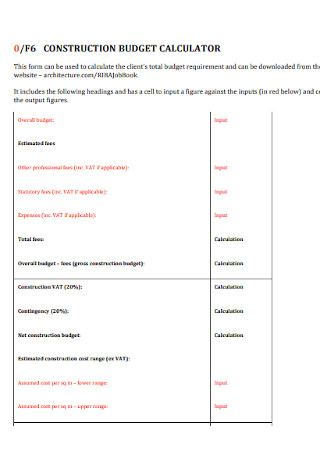

34 Sample Budget Calculators In Pdf Ms Word

34 Sample Budget Calculators In Pdf Ms Word

34 Sample Budget Calculators In Pdf Ms Word

Free 34 Loan Agreement Forms In Pdf Ms Word

Financial Analysis 34 Examples Format Pdf Examples

Calculate Compound Interest In Excel How To Calculate

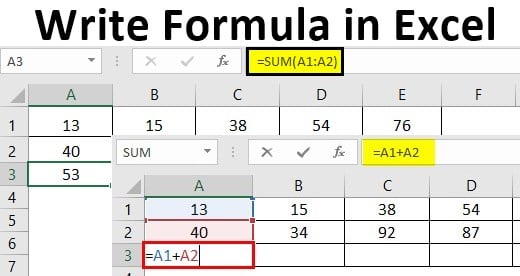

Write Formula In Excel How To Use Write Formula In Excel